October 2023 Newsletter

Did I really buy a Utility stock? Yes, I did! Good investors must be able to adjust their approaches as the market evolves. For the last decade, I avoided utilities because I figured that they were at risk due to historically low interest rates. Interest rates were bound to reverse any time… said me ten years ago. I was recently proven right, but was it a good strategy to avoid an entire sector for a decade? Maybe not.

Are Utilities Bad Stocks?

There are stocks I typically do not invest in. A good example is Gold stocks; they are bad investments with low average returns, long wait times, etc. Then there are forestry stocks, which I refuse to buy because I like trees and do not like how these companies manage forests. You might think that the utility sector would be in the same permanent penalty box. Unlike my other 2 examples, there is nothing inherently wrong with utilities other than their sensitivity to interest rates. Every sector has their own characteristics, some good, some bad. There is no reason to exclude these for such long periods of time from a portfolio.

Utilities 101

Let’s start at the beginning for those of you who may not know what a Utility stock is. For the most part, utilities are exactly what they sound like when you think of paying your bills: electricity, natural gas, water, sometimes sewage, garbage disposal, and recycling to some extent. The big players however tend to be energy related.

Utility companies generally do not have a lot of growth. They simply sell you electricity (as an example), make a profit doing so, and then share most of it with their shareholders, reliably, year after year. The model is simple, yet kind of old world restrictive. Unlike Google, which simply rents office space for its employees, utility companies must build and maintain very expensive and complicated infrastructure to operate their business. Business expansion occurs slowly as the companies generally have to borrow to raise capital; its not an easy business and is often government regulated, which caps profits.

You do not hear much about them in the news because they represent less than 3% of the SP500 index. They are a small boring player in the economy so it’ easy to forget them. You can see why I avoided these for so long.

Why Are They Like Bonds?

Since Utility stocks pay reliable dividends and don’t grow very much, their stock prices act much like bonds. They are not all that different, especially if there is little business growth. As I have said in the past, stock prices are a function of supply and demand, always. If interest rates go up to today’s 5% level for example, then your reliable utility dividend rate of 3% is no longer competitive against a risk free bond. Why would anyone take a risk on a company with no growth offering 3% when you can get 5% risk free? Their stock price must fall drastically so that the dividend yield becomes competitive again. Simple economics.

Performance

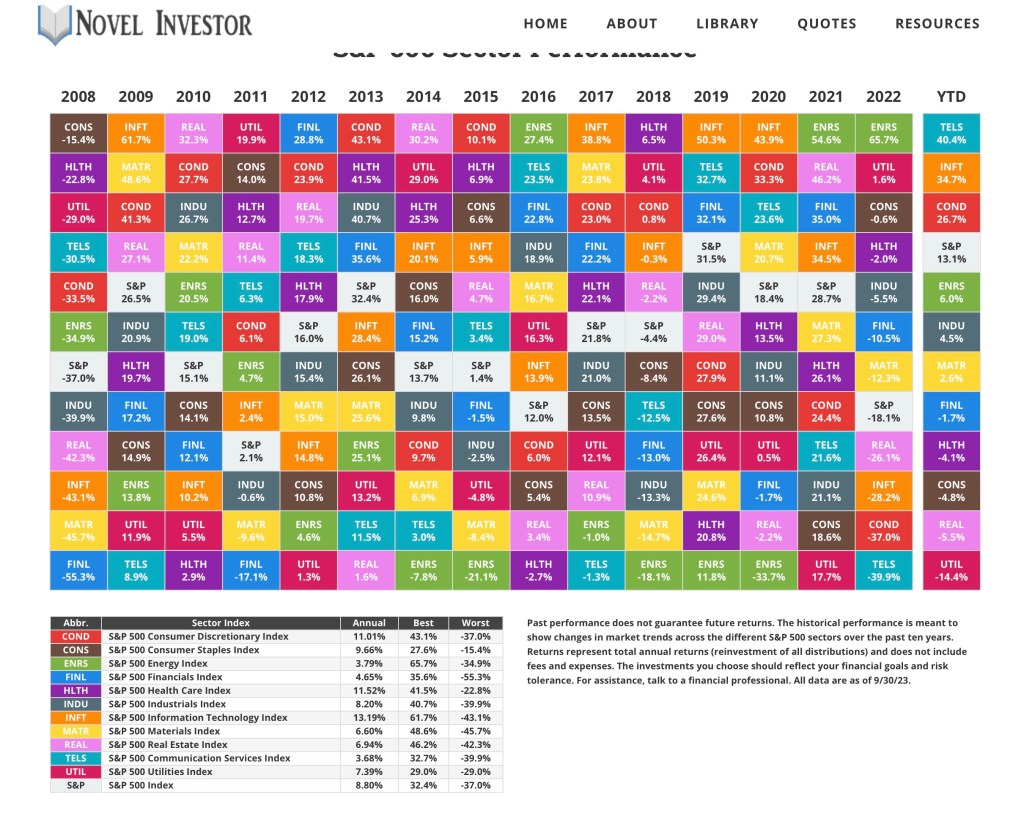

As it happens, Utilities are the worse performing sector in the SP500 index this year (-14%), they were also the worst (-17.7%) in 2021. It’s mostly because of rising rates. See Novel Investor image below for the latest sector performance for the last 15 years. Be aware that it’s not all bad news, they have had some very good years.

Relative to other sectors, Utilities rank around the middle. While the SP500 returned 8.8% over 15 years, utilities returned 7.4%. If you take into account risk and some pretty bad recent Utility Sector returns, overall that’s pretty good. Information Tech on the other hand returned 13%, which is amazing, but it has become a very expensive (read risky) sector. Its’ oversized effect on the average SP500 return is also worrisome. If you took the information Tech sector out of the index, Utilities would likely be neck and neck with the average.

Was Shunning Utilities the Right Strategy?

If rates started rising years ago, then certainly the “shun utilities” strategy would have been dead on. Investing is all about probabilities and not certainties, there is always a great deal of randomness involved. Even if something is likely to happen (rates go up soon), they simply may not. Nothing is certain, just different levels of probability. You’re best to play the odds, knowing that you can be wrong sometimes. This is what makes investing interesting. How often does one of your good for nothing stock picks double or triple, while your highest conviction “sure thing” pick drops in half? Happens all the time.

Time to Buy?

So is it time to buy Utilities? Honestly, I do not know. Simply speaking, you would need to know where interest rates are headed. If you knew that, you could bet everything you owned and become super wealthy. No one really does this because no one really knows, and neither do I. What I do know is that rates have climbed from basically zero to about 5% – the highest levels in 16 years. That is huge and the utility sector has been devastated. But just because rates have gone up a lot, it does not mean that they can’t continue going up. Rates were increased to about 20% in the early 80s to combat inflation, a similar situation is happening now.

The New Strategy

So my reasoning for buying, rightly or wrongly, is that lots of risk has been removed from utilities. Could rates go up and continue pounding utilities? Yes. So I have taken a half position with the idea that if rates keep going up and utility stocks keep falling, I will simply buy more until I achieve a 3% portfolio weighting. There are other less obvious but more important benefits for making the purchase. In my case, I have to consider portfolio management where diversification plays a key role in returns. The purchase increases diversification with the side benefit of lowering overall volatility. In addition, Utilities in the right context make a great defensive position should a recession come along.

Ok, So Which One?

After looking at hundreds of utilities stocks, I have to say that generally these are not the kind of companies that I would historically invest in. There are high yield 6-10% companies that are in my opinion “attractive but dangerous” because they have too much debt and are suffering from high borrowing rates. Most of the companies have very little opportunity for growth and those who have growth, are more expensive. You kind of get what you pay for in Utilities. My advice is that in the long run, you’re better with a lower yield (under 6%), a bigger company, some growth, increasing dividends annually, long history of dividend payments. These companies fared much better than other lower quality companies with bigger initial yields and as such, prices reflect that.

I eventually bought Fortis (FTS), a Canadian company that provides electricity and gas to customers in Canada, USA and the Caribbean. It’s a big player with a 26 billion market cap, and is considered the gold standard in Canada. It’s not particularly cheap, but it has growth opportunities which makes up for this. Its dividend yield is 4.4 % and has been increasing these annually for the last 50 consecutive years. In the short term, dividends are expected to grow at a rate of 6% per year. If you’re into Beta (a volatility measure), it scores a super low 0.23.

Something Has to Go

With a new sector being added to the portfolio, something had to be paired down. My energy sector positions have done so well that they became overweight. It makes it easy to move around money when this situation exists. While I was at it, I sold off MSOS a speculative Marijuana stock (small position) which did not work out, as well as a small cap ETF (VSS) which is too small to be relevant.

Marc’s Monthly Moves

- Sell half of Shell (SHEL) (+103% return)

- Sell MSOS (-73% loss)

- Sell VSS (+7% return)

- Buy Fortis (FTS)

Marc’s Portfolio YTD Performance

- Portfolio return: 9% (including currency gains)

- Portfolio return: 7.8% (without currency gains)

- S&P 500 return: 10%

- RSP ETF S&P equal weight -3%

- TSX: -1.4%

When Will this Under Performance End?

The portfolio has under performed the S&P 500 by 2.2% percentage points. I always get concerned about any deviation over 2%. Since I have moved further away from a USA heavy weighting, I believe that I am at a disadvantage to keeping up with the index. As long as a few very expensive market leaders continue to lead, I will likely not be able to keep up. The consolation prize is that the portfolio is less risky. It will likely over perform when the market finally realizes its wicked ways.